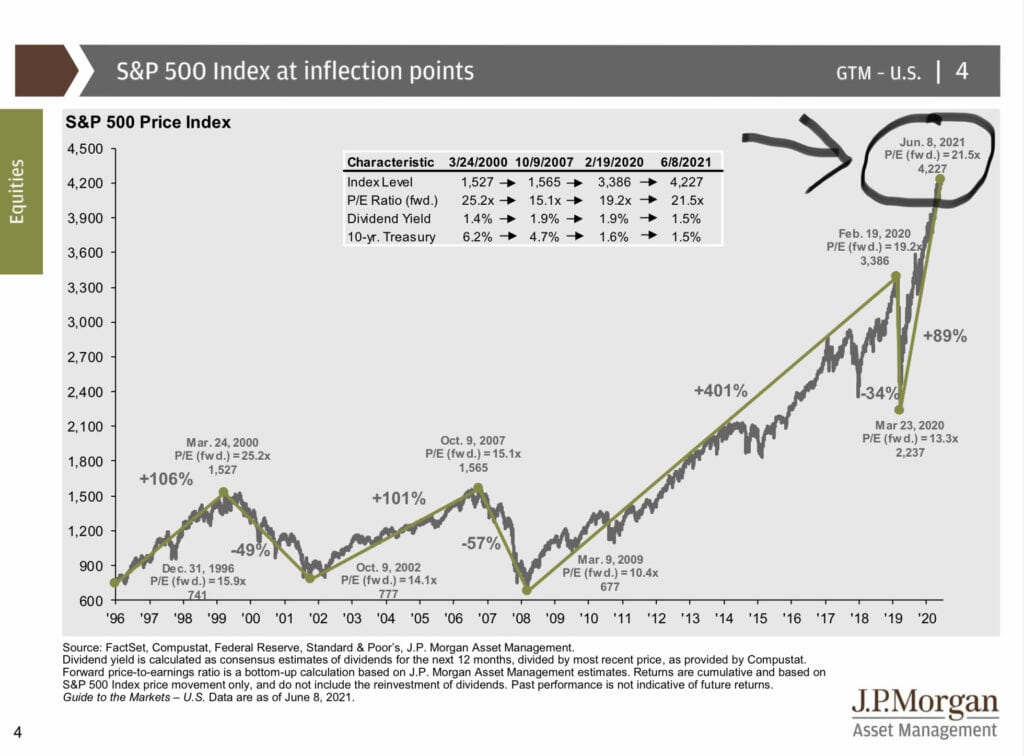

What’s the story behind the story? There are a lot of interesting things to see in this graph. Obviously, the S&P 500 index, which follows the largest five hundred stocks in America, has increased a lot since 1996 and rose dramatically from March 23, 2020. But the most interesting part of this chart is what I have circled in the top right, the forward P/E ratio.

The forward P/E is a ratio of price-to-earnings using forecasted earnings for its calculation. As of June 8, 2021 the S&P’s forward P/E ratio is 21.5x. Numbers are numbers, but when they are compared to themselves at different times, we see a story.

Here is what that means to me. The S&P’s forward P/E ratio 25-year average is 16.71x. Generally, when this ratio gets close to 13.0x I feel the stock prices are too low for how much earnings the stocks are getting and feel like it is a time to buy more stocks. When this ratio goes above 20.0x I feel the stock prices are high for how much earnings the stocks are getting and feel like it’s a time to start selling some stocks. So, when I see the current ratio above that mark at 21.5x I would normally be getting nervous, but this time I’m not because I know the story behind the story.

The S&P 500 index does, as the name implies, have 500 stocks in it, but they aren’t equally ranked. The story behind the story is that though the S&P as a group is at 21.5x the majority of them aren’t. If you took out the top 10, which are mostly tech stocks like Apple, Microsoft, Amazon, Facebook, and Google, the remaining 490 stocks have a forward P/E ratio of 19.2x. Which is still a little high but not terribly. The top 10 stocks alone have a forward P/E ratio of 28.6x which is alarmingly high.

My mom always told me not to assume and she was right. Just because some stocks are out of whack doesn’t mean all the stocks are. Sometimes the story isn’t so scary when you know the story behind the story.

Have a blessed week!

All investment and financial opinions expressed are intended as educational material. Although best efforts are made to ensure the only information is accurate and up-to-date, occasionally unintended errors and misprints may occur. Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., 7th Floor, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated. Dr. Baker has attained his D.Min., the designation for Doctor of Ministry, and his AIF®, the designation for Accredited Investment Fiduciary®.