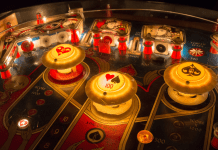

“I Love Rock and Roll” by Joan Jett & The Blackhearts was the top song; we all went to the movies to watch E.T.; Hall of Fame manager Whitey Herzog used his “Whiteyball” to lead the beloved St. Louis Cardinals to win the World Series over the Milwaukee Brewers. All in the year 1982.

Do you know what else happened in 1982? That was the last time we had inflation this high.

On Wednesday, January 12, the U.S. Labor Department released a report showing that inflation finished 2021 at its highest yearly level since 1982. It said that the consumer price index was up 7% in December 2021 compared to December 2020. That’s high.

The Wall Street Journal surveyed 1,600 U.S. chief executives about their concerns for 2022. Their number one concern was worker shortages, but inflation was a close second followed by supply-chain problems and Covid-19. Almost 60% of the CEOs of those surveyed said they are preparing for inflation to be high until mid-2023 at the minimum.

“Inflation is here,” Honeywell International Inc. Chief Executive Officer Darius Adamczyk said in an interview with the Wall Street Journal. “We have to be very, very careful how it gets solved, too, because it’s a little bit like driving your vehicle. If you slam on the brakes too hard, we could see the other side of inflation, which is a recession.”

The Federal Reserve, which I think caused a lot of this inflation, is finally beginning to focus on fixing it. Lael Brainard, the White House’s nominee to serve as the Fed’s No. 2 official, told Congress last week that reducing inflation is now the Federal Reserve’s “most important task.”

It affects us personally because our paychecks don’t go as far as they used to but for this article, the concern is how it affects our investments. We invest in companies to get a return. We want them to be profitable, but more and more companies are concerned that they can’t pass on these inflation costs because their customers are balking. High inflation costs are difficult because they can eat away at the profitability of organizations.

We’ve got to get inflation under control before it gets too wild because it’s not pretty when inflation goes wild. It’s like we have a runaway train but the people in charge, the Federal Reserve, have been reluctant to jump on it and slow it down. Hopefully, they are starting to do just that.

I don’t like 1982 inflation, but I could use a little more Ozzie Smith backflipping at a Cardinal’s World Series. Sadly, I think Ozzie is too old to backflip anymore, but then again, I think we all agree these inflation prices are getting old too.

Have a blessed week!

https://www.steadfastwealth.net/richard-baker

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.