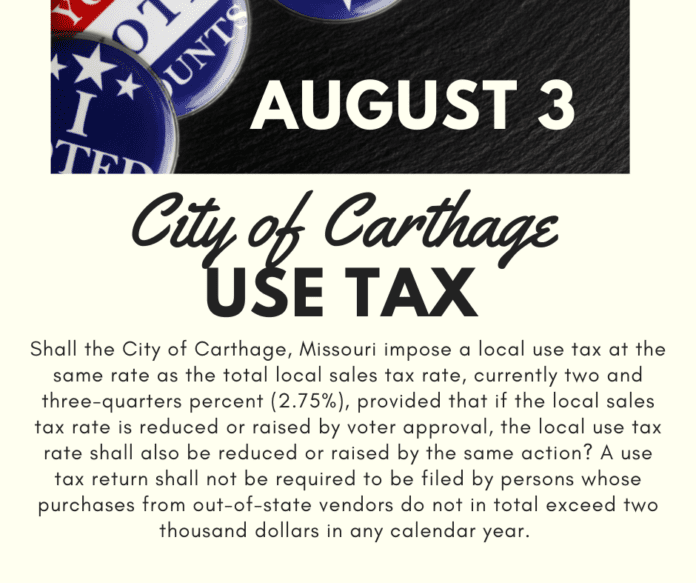

A Use Tax issue will appear on the City of Carthage August 3rd ballot. The purpose of the ballot issue is to ask voters to consider revenue from sales taxes collected from online sales. The ballot language reads as such:

“Shall the City of Carthage, Missouri impose a local use tax at the same rate as the total local sales tax rate, currently two and three-quarters percent (2.75%), provided that if the local sales tax rate is reduced or raised by voter approval, the local use tax rate shall also be reduced or raised by the same action? A use tax return shall not be required to be filed by persons whose purchases from out-of-state vendors do not in total exceed two thousand dollars in any calendar year. ”

We interviewed Ceri Otero, representing Ward Three on Carthage City Council. Quotes have been edited for clarity and conciseness:

Let’s start with an introduction because that introduction could also lead to a disclaimer. You are a city councilwoman, but you don’t necessarily represent the city. Introduce yourself.

Ceri Otero: I represent the constituents in the third ward specifically. It’s the citizens who I represent, not the city as an entity. I want to give that disclaimer because the things that I say are not representative of everyone’s opinions on the council, they’re certainly not representative of city administration or something like that because city administration implements what the council asks them to after something has been passed. We are not in that stage yet where I can speak for anyone besides just myself and the folks who I have talked to – the constituents I’ve visited with and the folks that I represent.

But because you do attend city council meetings, you actually understand what the use tax is and that’s why we’ve invited you here today.

Well, I do. And the city council is who voted to put the Use Tax issue on the ballot on August the third. Sometimes people feel like, well, is that something that the city does? It’s your representatives who vote as to what’s going to go onto the ballot. There are a lot of good reasons why city council voted to put this on the ballot this year. Hopefully, I’m going to be able to share some of that information to give that context. So folks can make a good decision.

Let’s get started and tell us about the use tax. What exactly is it?

Use tax is possibly the most confusing name for this ever, and to be clear, none of us here in Carthage get to name it. That happens at a much higher level than us. Basically, a use tax is identical to a sales tax. That’s the easiest way to say it. Obviously, there are a million little details, and if you enjoy reading the fine print of things there, there are certainly lots of documents you can look at for all of that. But the very simple way to explain Use Tax, it’s like a sales tax, but in our particular instance in 2021, what we’re facing right now is that internet sales are not necessarily treated the same way as sales. When you shop anywhere in Carthage, right now, you pay a sales tax, but if you shop online (and let me just say, I shop online for lots of reasons) when I shop online, most of the retailers do not collect a city sales tax. So really the use tax is to capture the evolving nature of shopping habits. Shopping habits have changed so much over the last decade, the last five years, the last one year. We’ve seen so much evolution and as more people have internet access and become more and more comfortable with technology, online shopping sales tend to grow, not shrink. And it looks like this is going to continue to be a trend for many years to come. So this is capturing those sales tax dollars that are not being captured by the local businesses. No one would ever pay both a use tax and a sales tax on the same item. It’s an either-or so sales tax is in-person; use tax is for online purchases.

Technically this is not a new tax. It’s a tax that we’ve been paying when we go to in-person sites. And it’s a tax that will then apply to internet sales.

Ceri Otero: Yes, exactly. So it is absolutely not a new tax. It is just a response to the way that our system is set up. You know, online sales were not a thing when the Missouri legislature made sales tax rules back many, many decades ago and allowed cities to create local sales tax to fund independent municipalities. Internet sales were not a thing; that wasn’t being evaluated. The Use Tax proposal is really just responding to those changing shopping habits and kind of closing – it almost feels like a loophole that if you buy something online you don’t have to pay your local tax. Even though those purchases ate getting delivered by USPS, UPS, FedEx, it’s getting delivered by somebody who’s driving on city streets using the city infrastructure. It’s really just making it the same across the board, whether you’re making the purchase in person or you’re making the purchase online.

Considering the information on the ballot language, what is this $2,000? Because the idea is that Use Tax is not a new tax, is it’s a tax that we always should’ve paid?

Ceri Otero: This is where should explain that I’m not a tax expert, but yes, this is actually part of what we’re supposed to do. The way that the laws are written, we’re actually supposed to be keeping track of any of the purchases that we made from out-of-state vendors, and this rule goes back well before internet sales. Even 20 years ago, if you made a purchase from an out-of-state vendor and you paid $10 item, you paid $10 and they sent it to you. You were then supposed to pay the sales tax that you would have paid. If you’d bought it in town, you are supposed to pay that when you filed your state income tax, each April.

Everyone’s going to say, I hesitate to say that I have not done a stellar job at that. And I’m going to guess that most people have not. Here’s the thing, no one was coming through and auditing people on those kinds of purchases. It was the honor system, which worked fine when people weren’t making very many purchases outside of in-person transactions. There wasn’t a lot of that because shopping habits have skewed so heavily to online purchases.

Now, technology brings software available for these vendors. I don’t want to necessarily name drop, but there’s a, there’s a giant retailer that everybody gets a big smile printed on the box when they receive it, fully capable of collecting sales tax. In fact, they do collect the Missouri state sales tax. But until we opt in to say, yeah, we need you to also collect our city sales tax – here’s the ballot measure for it; here’s an agreement from citizens that we want you to collect this for us. The Use Tax question is really kind of just to capture that low-hanging fruit of big internet vendors who are not currently collecting city sales tax, and this loops them in so that they’re doing the same thing that our local merchants are already doing.

We wouldn’t have to track our online purchases; tracking would be the responsibility of the vendor, just like we don’t go to Walmart and keep our receipts and file all those with our tax consultant at the end of the year.

Ceri Otero: Could you even imagine if you had to keep track of every purchase that you have paid in person and take in that stack of receipts and do the math on it? No, the laws are set so that our local merchants collect that on our behalf at the time of purchase. So this is just adding that to the online sales, so it’s happening at the time of purchase. There’s nothing you have to report later when you’re filling out your tax forms, which is obviously more convenient for everyone. For

I know that a lot of the hesitancy I see online is from people that do not want to pay more taxes, but then in that same feed, you see a lot of people that are saying, we want better roads. It seems like those are, those are linked in some fashion.

Ceri Otero: My thought on it is, I can understand not liking taxes because it always feels like, Hey, that was mine. I understand where you’re coming from there. However, this system that we have in the state of Missouri is that municipalities are funded in large part from local sales tax and you can like the system or not like it, that part doesn’t matter. We don’t have a way locally to change the system and to get funding in a different way. That is the system we have. I feel like as a representative when I got into my role and really had a chance to attend all of our meetings and hear about things and get to see what the trends are from year to year, and how did the numbers go? We see major increases in sales tax as more people visit our community or what have you seen those numbers?

They’ve plateaued kind of consistently over a number of years, despite the fact that we know that we have more people in town than we used to have. You would assume that we’ve got more people who are shopping and making purchases. The fact is that those sales tax numbers haven’t grown dramatically over the years, but we know consumption hasn’t gone down. That tells me that my job as a representative is to look at this and see, are we doing things today that set us up well for the long haul, are we, are we making decisions today that are helpful in the future? And so I feel like what I’ve been tasked with from my constituents is to find out all this information and bring it back to them. Here’s the information, here’s what I found. The Use Tax would really go a long way to set things up for the long haul so that we are collecting our sales tax from both our in-person shoppers and our online purchases.

When you talk about the difference between in-town purchases and out of town purchases or online purchases, I know that small businesses are really advocating for this because they feel at a disadvantage competing against some of those large online retailers when they feel that they are collecting a tax and unable to pass that exception onto their customers.

Ceri Otero: It’s true. Say you’re a local business and you’re selling an item to someone for $10, then at the register, you know, that 2.75 cents local sales tax is collected as well and that local retailer has the administrative burden of sending the accumulated dollars into the state and taking care of filing the taxes for us. And we couldn’t do this without the cooperation of our local businesses. It is a little unfair to our local businesses that these online vendors just get to opt-out of that process; they do have to collect the sale on the state portion of it, but there’s no obligation for them to collect the city portion sales tax. This ballot measure is looping them in so that it’s a more level playing field between our local businesses and those online retailers.

Is there anything else that we should consider?

Ceri Otero: I am always happy to talk to folks; you can certainly provide my number and everyone who lives inside city limits has a council member; we each have two city council members per ward. You can reach out to your local council member if you would like more details. We’re all glad to explain. As to why we put it on the ballot in the first place, if people want more information about that, people have questions about what this means specifically in different instances. We don’t always know all of those answers, but we know who to check with or how to find them out. We’re always glad to get more information to people. This is one of those things that when someone listens to the information and arrives at their decision based on all of the information, then I don’t mind what their vote is. Whether they agree or disagree with me, I hate to see someone make a decision without knowing why they’re making it. And so my goal is just to make sure that people understand at least what’s involved so that they can be fully informed, whatever their vote is.

I think that that’s one reason Virtual Carthage engaged this issue as well as we really want to see people get out to the polls on August 3rd. And remember that “We, the people…” is a responsibility and not an entitlement.

Ceri Otero: Absolutely. It is our responsibility. Whether you love our system, whether you hate it, whatever, This is the system we’ve got; we’re funded by sales tax, and we get to make choices about it. So make an informed decision and then please show up at your local polling place on August 3rd.

—–End Interview—–

When I talked with Ceri Otero, we didn’t get a chance to dive deep into how those funds would be spent if the city use tax passed and the city was allowed to raise more funds. As I mentioned, there is a city use tax committee, and that committee is made of several volunteers from the community, including:

The committee recommended and City Council approved the proposal of the committee to specify 40% for parks and recreation, 30% for public safety, and 30% for infrastructure and modernization. If you look at the city council minutes, there was a little bit of a discrepancy regarding public safety versus infrastructure and modernization in the city of Carthage. We have several roads that should be repaired and bridges that may need to be repaired in the future. Looking at some of those issues and trying to figure out how to pay for those repairs, the members of city council were a little bit at odds with how the committee recommendation should be applied.

August 3rd is a day for voters to hit the polls and identify priorities to their legislative officials by voting to approve (or declining) revenue streams that will support initiatives in local government. The Carthage Press and Virtual Carthage have produced a lot of content to make voter information available to all users. To be clear, the content provided in the links below is all repetitive and nearly the same language, but it is provided in formats that should appeal to readers, listeners, and viewers. Please take time to review the format in your preferred method and go vote on August 3rd.

Podcast – Ten Minute Tuesday

Video Interview with full-screen graphics – Virtual Carthage on YouTube