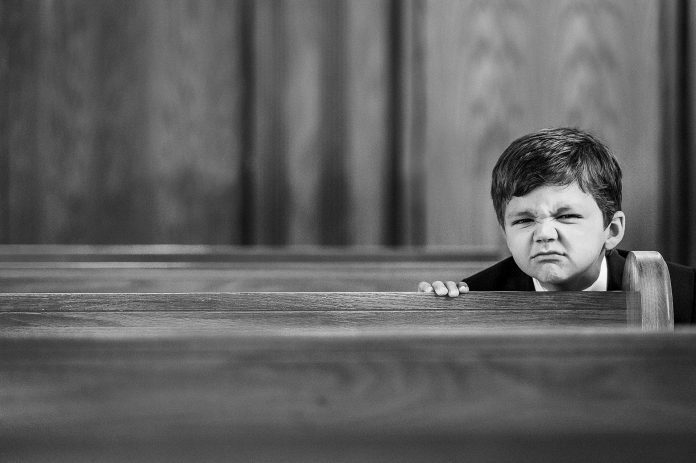

Straighten up! I don’t read lips well but even sitting several pews back from my mom in church I knew what she was saying. I knew that sitting lower in the pew where she couldn’t see me wasn’t an option and that I needed to straighten up quickly. One of my clients said to me recently that they “hope the market settles down” and I reminded them that the stock market doesn’t settle down it “settles up.”

I have a chart that shows the stock market since the year 1900 which notes historical crises, such as WW1, the Great Depression, WW2, the Korean and Vietnam wars, and the Global Financial crisis. It starts on the bottom left of the page and climbs and dives and climbs again across the page ending on the top right side of the page.

Just like driving from Branson, MO to Springfield, MO, you might be going downhill at times but you are gaining altitude the entire trip. The market is the same. There will be down times like this year but the market gains altitude and settles up.

So far, this year hasn’t seen a full-blown crisis like any of the others noted on my chart, but it has been bumpy. We may not be flying into a storm, and there’s been plenty of volatility in the first part of 2022, but there are some positives.

– The S&P 500 is about 6% higher since this year’s bottom on June 16 and on July 19th it had a one-day positive return of 2.8% which was its third best gain of the year.

– During the July 19th rally the S&P 500 Index, Dow Jones Industrial Average, and Nasdaq Composite all finished up over 2% and moved above their 50-day moving average for the first time since April.

– With 10% of S&P 500 Index companies having reported their earnings, a strong 69% of companies have beaten analysts’ targets according to LPL.

As we look towards the rest of 2022, it can be hard to get our bearings when there are so many unusual influences happening at the same time, such as forty-year high inflation, the Federal Reserve on its heels, and two European countries at war. All these forces are having an impact on financial markets.

I believe the real test for the S&P 500 seems to be when it gets close to 4200. (As I write this it’s at 3966.) It got close to 4200 in May but fell back before going above it. There seems to be more sellers than buyers at that 4200 level. It’s going to take some strong momentum to shoot past the 4200 resistance level. It might get close and bounce off it a few times before it breaks through but I see some positive momentum. It might get some help from some historical patterns concerning midterm years, the election, and Christmas sales will offer support toward the end of the year.

I was a rowdy kid whether I was in church or not. I remember one time I didn’t straighten up and my mom did the unthinkable. She got up and made a big scene about walking back and sitting between me and my friend and then whispered threats in my ear. Everyone on the back roll straightened up then. I think some momma needs to go sit with the stock market and whisper some threats in its ear to straighten it up.

Have a blessed week!

https://www.steadfastwealth.net/richard-baker

https://www.facebook.com/Dr.RichardBaker

2760 East Sunshine St. Springfield, MO 65804

Opinions voiced above are for general information only & not intended as specific advice or recommendations for any individual. All performance referenced is historical & is no guarantee of future results. All indices are unmanaged & can’t be invested into directly. Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.

The economic forecast outlined in this material may not develop as predicted & there can be no guarantee that strategies promoted will be successful.