I’m impressed with the advanced guardrails that road departments are putting in the last few years. The majority of it continues to be steel posts and strong steel cables, but now they have added a few wood posts on the end pointing to oncoming traffic.

These wood posts are supposed to still keep an out-of-control car from going where it shouldn’t but instead of being a hard structure that cars bounce off of the wood posts are designed to break off allowing the out-of-control car to be slowed down and caught instead of stout wall to bounce off of.

The stock market’s 50-day Moving Average sort of does the same thing. The 50-day moving average is probably the most used technical indicators with investors. It helps us see trends in stock to see where the stock or index is gaining strength or showing weakness by drawing a line on the chart that shows the average closing price from the past 50 trading sessions.

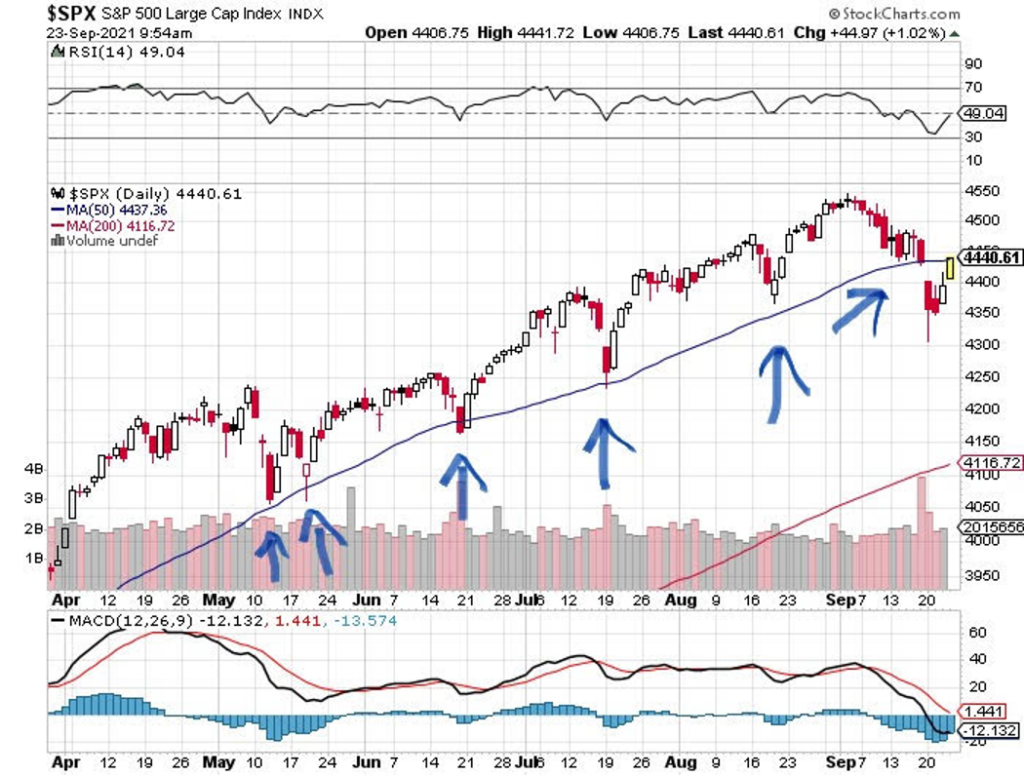

Since the most recent record high on September 2, 2021, the S&P 500 fell about 2% until September 14th where it “bounced” off its 50-day moving average. What I am wondering is how long will the S&P 500, a gauge for the total stock market, continue to bounce off its 50-day average and continue to go back up.

The S&P 500 flirted with its 50-day average eight times this year (I drew arrows noting six of them on the chart above), bouncing off it each time and going back up, except one time. That caught my attention.

The S&P 500 didn’t immediately bounce back up from its 50-day average on Friday, September17, 2021, which could be a warning sign of a correction in the making. That Friday had a lot of negatives going on such as the stock market index futures, stock market index options, and stock options all expiring which historically makes for a volatile day.

The market closed below its 50-day average a few times this year and then went back above that level not long after. But when it did it on September 17, it felt different to me. Time will tell us if it was just a bad day or a start to a new trend.

The day I took my first investment licensing exam I fell asleep on the way home and bounced off the railing which woke me up and saved my life. Bouncing off something works great until the time you are going too fast and you break through the barrier. I hope the market keeps bouncing upward.

Have a blessed week!

Investors cannot invest directly in an index. These unmanaged indexes do not reflect management fees and transaction costs that are associated with some investments. Past performance is no guarantee of future results.

All investment and financial opinions expressed are intended as educational material. Although best efforts are made to ensure the information is accurate and up-to-date, occasionally unintended errors and misprints may occur. Advisory products and services offered by Investment Adviser Representatives through Prime Capital Investment Advisors, LLC (“PCIA”), a federally registered investment adviser. PCIA: 6201 College Blvd., 7th Floor, Overland Park, KS 66211. PCIA doing business as Prime Capital Wealth Management (“PCWM”) and Qualified Plan Advisors (“QPA”). Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. PCIA and Private Client Services are separate entities and are not affiliated. Dr. Baker has attained his D.Min., the designation for Doctor of Ministry, and his AIF®, the designation for Accredited Investment Fiduciary®.