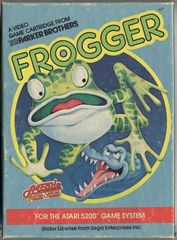

I loved playing Frogger on my Atari 5200. Frogger was an arcade game where the player directs the frog at the bottom of the screen between opposing lanes of traffic without getting ran over. Later the frog had to jump from log to log or risk drowning. It’s a timing game. If you don’t time the crossing perfectly your frog dies, and you lose the game. Sometimes people try to time the stock market and lose more than an arcade game.

The stock market in 2022 has been hard to swallow for investors so far. April was one of the worst months in decades for the S&P 500 Index, and May is off to a rocky start. Bonds which usually give us some downside protections have gotten hit as well because rising interest rates have pushed down bond prices.

The stock market doesn’t like uncertainty and it’s getting a lot of it this year with high inflation, the Federal Reserve seemly asleep at the wheel, COVID-19 shutdowns in China, a continued global supply chains mess, and of course a nasty war in Eastern Europe.

We’ve seen a lot of big swings (volatility) in the market, both positive and negative. On May 4th we had the big Fed rally, where the market was up about 3%, and then the very next day, on May 5th, the market went negative 3.6% which was frustrating.

During market volatility like we are going through, I see investors make mistakes. The most frequent mistake is trying to time the market by jumping in and out. When someone tries to time the market, they must be right twice. They must get out at the perfect time and get back in at the perfect time, which can be an extremely difficult needle to thread.

The stock markets can turn quickly and missing even just a few big “up” days can hurt your overall investment returns over time. Putnam Investments says that if an investor remained invested for the 15 years from 12/31/06 to 12/32/21 their $10,000 investment would have grown to $45,682, or a 10.66% return. But if that same investor over the same period missed the 10 best days in the market their $10,000 investment would have only grown to $20,929, or a 5.05% return. Because they missed less than one day a year in the market.

I remember in June 2016 when the market fell over 5% in two days because of the Brexit vote. It was crazy watching the market fall so quickly but then it bounced back in a crazy three-day rally. The biggest daily gains tend to come in down markets, making them nearly impossible to predict. Time in the market and not “timing the market” is a better strategy for most investors. Trying to time the market is a lot like betting on moments in time. I’m not a gambler nor am I an emotional investor. I’m staying in the market.

I think we are going to continue to see short-term market volatility where the market could swing up or down 1% during a day. This is a time when seasoned long-term investors are looking for short-term opportunities during times of increased volatility because some of the best investment opportunities are when fear is the highest.

Even as a kid I had a problem with the log jumping part of the Frogger game because frogs can swim. A frog doesn’t die when he falls off the log because he just starts swimming. The frog in Frogger should have stayed in the water and not have gotten out to ride a log in the first place. Maybe, there’s an investment lesson in that.

Have a blessed week!

https://www.steadfastwealth.net/richard-baker

https://www.facebook.com/Dr.RichardBaker

2760 East Sunshine St. Springfield, MO 65804

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Securities and advisory services offered through LPL Financial, a registered investment advisor, Member FINRA/SIPC.

The economic forecast set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Past performance is no guarantee a future results.